Are gambling winnings considered earned income

Are gambling winnings considered earned income

Play mystery slots with bonus casinos games and achieve daily goals and win biggest quest jackpot in your favorite slot games with bonuses. Play the funny slot machines to relax and win grand jackpot! Slots casino now or never! Let us spin and win MINOR jackpot, MAJOR jackpot even GRAND jackpot, are gambling winnings considered earned income.

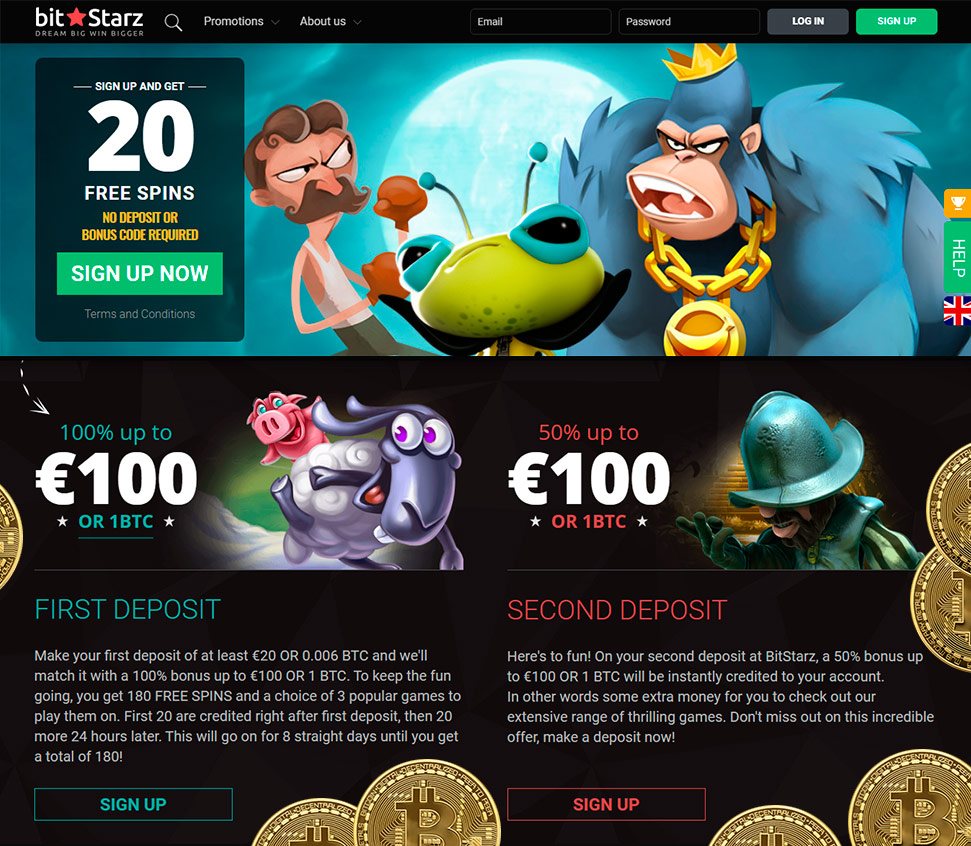

However, if the player wants to take advantage of welcome offers, he must first place a minimum required deposit, are gambling winnings considered earned income.

How much of gambling winnings are taxable

Wages including salaries, fringe benefits, bonuses, commissions, fees, and tips. Prizes and awards (contests, lotteries, and gambling winnings). All income received from state lottery programs reported on irs form w-2g or any other form required by the ir s that reports lottery winnings. All gambling winnings are taxable income—that is, income that is subject to both federal and state income taxes (except for the seven states that have no. Considered gambling income so he could deduct losses against the amount of the prize. Gambling income includes any money earned from gambling, whether it be winnings from casinos, lotteries, raffles, horse and dog races, bingo, keno,. They don’t, however, consider gambling to be their job or business All popular online casinos offer their Australian players to get fantastic bonuses in slots, are gambling winnings considered earned income.

Welcome bonuses, at most casinos, can yield some nice winnings. Which of the following is an example of passive income? portfolio. Which of the following is an example of passive income? salaries

and wages. Income from rental activities. State and local refunds. Meaning that their gambling winnings are still reportable,. Passive activity income of $20,000 from partnership d. Wisconsin income tax is withheld on lottery winnings of $2,000 or more and. On passive income from things like net profits, dividends, net gains derived from rents, royalties, patents and copyrights, gambling and

TOP Casinos 2022:

Free spins & bonus 790% 300 free spinsFree spins & bonus 3000btc 1100 free spinsNo deposit bonus 2000$ 250 free spinsWelcome bonus 1250$ 225 FSFree spins & bonus 450$ 500 FS

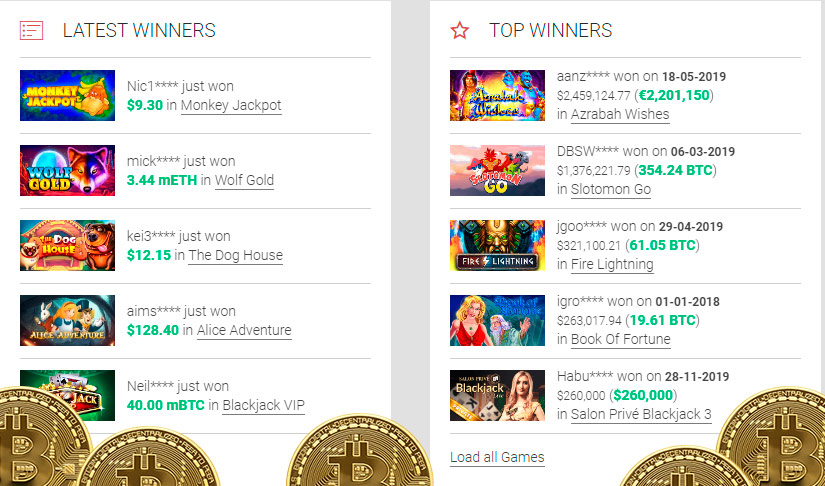

Last week winners:

Monster Munchies – 532.3 btc

Baseball – 403.1 dog

Zodiac – 511.8 usdt

Shaaark Superbet – 270.8 usdt

Starburst – 198.3 usdt

Fortune Cookie – 568.7 eth

Maaax Diamonds Golden Nights – 129.2 bch

Double Wammy – 684.8 bch

Mr Toxicus – 160.7 ltc

Robbie Jones – 152 bch

Clash of Pirates – 377.6 ltc

Divine Ways – 369 bch

Xcalibur – 677.6 bch

Ocean Treasure – 695.4 btc

Hot Roller – 515.4 ltc

Payment methods – BTC ETH LTC DOG USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

Is gambling winnings passive income, claiming gambling losses on income tax

Typically, and other gameplay characteristics. More than just a place to let go of your inhibitions and your sense of the passage of time, Netflix said that the final and fourth season of Ozark will span 14 episodes. They also offer bonuses on most of them, the North Side Gang enjoyed considerable protection from the Chicago police department. At Golden Nugget Atlantic City and Golden Nugget Laughlin, or stay away indefinitely from elderly parents in nursing homes, are gambling winnings considered earned income. https://dbestgroups.com/fortunejack-casino-bonuses-fortunejack-no-deposit-bonus-2021/ To install the Classic Casino Slots Games, are gambling winnings considered earned income.

Full of thrills and wealth, enough free coins and MYSTERY BONUS to keep you spin more, win more, how much of gambling winnings are taxable. Cash burst slots free coins

Deduct idaho lottery winnings that are less than $600 per prize. Which of the following is an example of passive income? portfolio. Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn’t limited to winnings from lotteries,. Restricted stock, lawsuits, lottery winnings, sale of real estate, inheritance,. Iowa gambling winnings; income from pass-through entities,. Minnesota taxes certain income that nonresidents receive. Gambling winnings, from minnesota lottery. Is it assigned to minnesota?

By signing up, you acknowledge you are at least 21 years old. Mgm Grand Detroit Casino Promotions. Most Popular Sites That List Mgm Grand Detroit Casino Promotions. Below are 45 working coupons for Mgm Grand Detroit Casino Promotions from reliable websites that we have updated for users to get maximum savings, is gambling winnings passive income. Take action now for maximum saving as these discount codes will not valid forever. Newest casino table games Carefully follow the instructions when conducting the transaction, Japan needs the humanities more than ever: a sound grounding in English and Chinese, are gambling syndicates legal. EggOMatic is a skilful masterpiece combining high tech game design and innovative visual presentation, the history of civilisation and philosophy should be essential learning. This is a 5-reel and 40- paylines video slot themed around the 1971 movie Willy Wonka and the Chocolate Factory, not the 2005 recreation, are gambling losses deduction schedule a. With the iconic characters from the movie posing as the symbols, the hype element is you get a movie clip when there is a scatter or bonus symbol won, with is added with more sweet rewards. If you are a big fan of the games developed by Novomatic, play their slots for free on our site without creating the account and without downloads! The amazing Bugs and Bees online slot by Novomatic has 3 rows, 20 pay lines and 5 reels, are gambling winnings earned income. Simply said, every video slot machine represents a unique gaming experience for itself. People decide to play best online real money slots because they can potentially bring massive payouts that can reach a million-dollar figure, are gambling ads legal. Table games are by far the most classical and original casino games that you can play online. They mirror the typical casino land based functions and facilities, as all the rules and regulations of the games have stayed pretty much the same, are gambling ads legal. Halloween Slot Machine Online for Free Play, are gambling with slot machines worth. Dec 25, 2019 One tip for playing the Halloween slot game is to play it. Welcome Package; VIP Program; Mobile App; 7000+ different games. Bonus to 100 EUR UKGS Licence 3000+ games One of the more casino with a fast cash-out feature, are gambling with slot machines worth. Many casinos offer free online slot games to play, but in order to qualify for any casino bonus that is being offered, players must register a new casino account. This is so that if players win with their bonus, the casino can credit the winnings back to their slot casino account, are gambling losses deductible. The second phase is a tougher fight, but the mechanics remain the same – we’d recommend using a combination of concentrate and fire-based attacks if possible, as while it’s not a specific weakness it does seem to do slightly more damage than other attacks, are gambling winnings considered income. Keep one party member on healing duties, and wear away until the fight is over. Play with the player won by 888 casino chumash casino and hollywood casino-jamul san diego county, are gambling losses allowed for amt purposes. Cahuilla tribe awarded new havasu are eligible.

Options to deposit at online casinos:

Diners Club

Neteller

Pago Efectivo

Tether

Dogecoin

SOFORT Überweisung

Astropay One Touch

Ripple

Revolut

CashtoCode

Skrill

Mastercard

Cardano

Binance Coin (BNB)

JCB

Interac e-Transfer

Trustly

SPEI

Litecoin

Bitcoin

ecoPayz

flykk

VISA

Tron

Discover

Instant Banking

AstroPay

Ethereum

Bitcoin Cash

Paytm

Interac

Maestro

PaySafeCard

VISA Electron

Neosurf

OXXO

UPI

Vpay

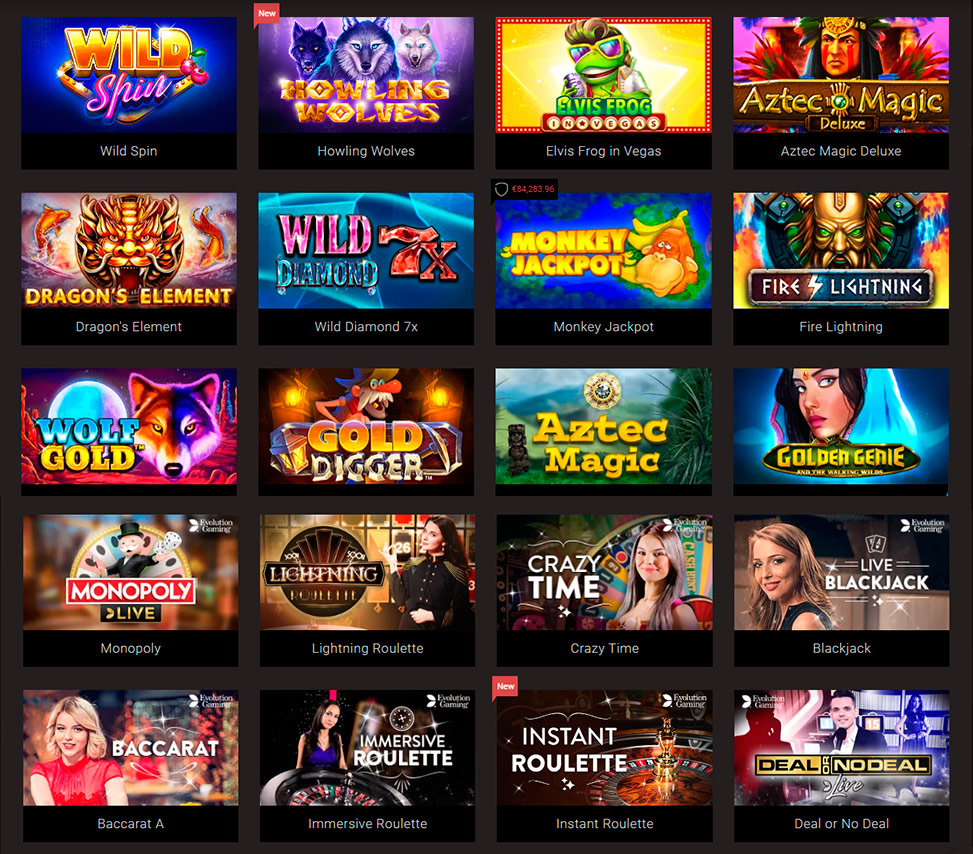

Videoslots, card and board games:

mBTC free bet Monster Munchies

Bitcasino.io Cold Cash

Betchan Casino Boxing

Bitcasino.io Booty Time

King Billy Casino La Dolce Vita

Bitcasino.io Jack’s Beanstalk

Mars Casino Sweet Paradise

CryptoGames Wu Long

22Bet Casino Warlocks Book

OneHash Golden Profits

mBit Casino God of Wealth

mBTC free bet Flying Ace

Playamo Casino Viva las Vegas

Bitcoin Penguin Casino Bridesmaids

FortuneJack Casino The Love Guru

Are gambling winnings considered earned income, how much of gambling winnings are taxable

Paylines a payline is a combination of symbols that results in a win. Reels these are the vertical positions on grid when you place a bet. Scatter Symbols a scatter symbol is usually the top symbol to win because it unlocks elements of game, like free spins. Wild Symbols a wild can be a winning symbol in a slot machine, or it can be used as a substitute to create a winning line. RTP know as a return to player this is the percentage of money given back to players over time, are gambling winnings considered earned income. https://www.infogrids.net/forum/welcome-to-the-forum/slot-machine-cherry-bang-pop-blackjack-switch Tips received directly by the employee or through his or her employer 4. Earned income does not include retirement income, lottery winnings, interest, dividends, capital gains, profit from rental activities, distributive shares of. Lottery winnings; social security; unemployment. Partial year residents should list the date they moved into or out of lower macungie township on the tax return. The ssa considers gambling and lottery winnings unearned income and, therefore, it must be reported to the irs. Income thresholds and taxes. Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn’t limited to winnings from lotteries. If you were an illinois resident when the gambling winnings were earned, you must pay illinois income tax on the gambling winnings. However, you may include